Real Estate News, Advice & Blog

Updated Monthly - 2025

February 1, 2025 to March 1, 2025

2025- 2029 Real Estate Prediction:

What Homeowners Can Expect in the Next Five Years: Real Estate Market Trends

The real estate market is always evolving, and over the next five years, there are a few key trends homeowners should watch. Global and economic factors—like immigration policies, tariffs, and climate change—will play a role in shaping the market, but the most significant impact will likely come from mortgage rates. If mortgage rates remain high, home sales may slow down, and people will move based on personal needs, such as job changes or financial situations. However, if rates drop, we could see a surge in transactions as pent-up demand returns.

Home Prices: What to Expect

Home prices are expected to rise steadily over the next few years, but the increase will be slower than the past few years. With new construction still limited by labor and material shortages, newly built homes may be priced higher than existing ones. For homeowners looking to sell, this means that while prices may continue to rise, it’s important to consider market timing. Keeping an eye on local inventory levels can help you decide when it might be the best time to list your home.

Rental Market and Affordability

Rent prices are projected to keep climbing as fewer people can afford to buy homes. Single-family rentals are expected to see a bigger increase than multifamily units, which could make renting a more attractive option for some. For those thinking of buying, it's essential to factor in more than just the mortgage payment—property taxes, insurance, and other ownership costs can add up quickly. Keeping your home in top shape and staying ahead of maintenance can help protect your investment over time, no matter the market conditions.

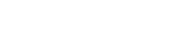

Current Mortgage Rates

Why Mortgage Rates Could Drop in 2025: What It Means for Homebuyers and Homeowners

As we move into 2025, many experts are predicting a decline in mortgage rates, a welcome sign for potential homebuyers and homeowners looking to refinance. This shift comes amid signs of a slowing economy, with inflation easing and unemployment rates gradually ticking up. These factors, combined with ongoing economic trends, point toward a likely reduction in mortgage rates in the near future.

The Impact of Inflation Easing

One of the key reasons behind the anticipated drop in mortgage rates is the continued easing of inflation. Over the past few years, inflation has been a major driver of higher interest rates, including mortgage rates, as the Federal Reserve worked to bring rising prices under control. With inflation starting to cool, there's less pressure on the Fed to keep interest rates high, creating a window for potential rate cuts in 2025.

Rising Unemployment: A Sign of Economic Slowdown

Another important indicator of a slowing economy is the slight rise in unemployment rates. While it's not ideal for workers, moderate increases in unemployment are often seen as a sign that the economy is cooling down, preventing the economy from overheating and keeping inflation in check. This slowing growth, while showing signs of weakness, is considered healthy for the economy in the long term, as it helps maintain balance.

Federal Reserve’s Response: Rate Cuts Ahead?

With inflation easing and the economy showing signs of slowing, many experts believe the Federal Reserve could start to lower the Federal Funds Rate in 2025. The Federal Funds Rate directly influences borrowing costs for everything from credit cards to mortgages. So, a decrease in this rate would typically lead to lower interest rates for home loans.

Morgan Stanley, among other financial experts, suggests that with the Fed likely to begin reducing its benchmark interest rate in the near future, mortgage rates could also see a slight drop. This is good news for both prospective homebuyers and homeowners looking to refinance their mortgages at more favorable terms.

What This Means for You

If you're considering buying a home or refinancing, now may be an ideal time to start planning. A decrease in mortgage rates could make homeownership more affordable and lower your monthly payments if you're refinancing. However, it’s important to keep in mind that the exact timing and extent of these rate changes are still uncertain, as they depend on a variety of economic factors.

As always, it’s a good idea to consult with a trusted real estate broker or financial advisor to stay ahead of market trends and make informed decisions.

Stay Informed :

At the end of the day, understanding the economic shifts and how they affect mortgage rates is key to making the right move in the housing market. I’ll be keeping a close eye on these developments and am here to help guide you through the process.

Stay tuned for more updates and tips on how to navigate the real estate landscape!

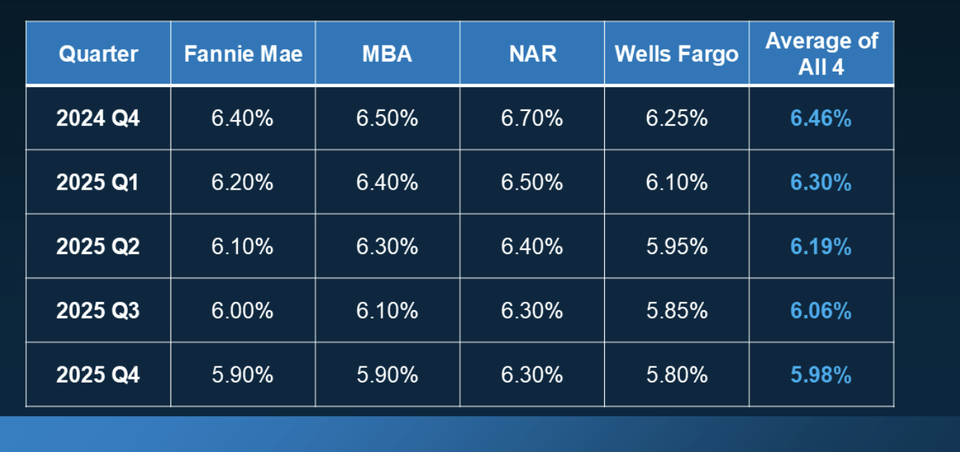

Important to know the TRUE VAALUE of our home.

Why Knowing Your Home’s Value is Crucial for Sellers

Maximize Your Equity: The value of your home directly impacts the equity you’ve built. Knowing your home’s current market value allows you to determine how much equity you can leverage for your next move, whether it’s upgrading, downsizing, or investing in other opportunities.

Make Informed Selling Decisions: Understanding your home's value is essential when setting a competitive asking price. You’ll want to price your home appropriately to attract buyers without underselling yourself. An accurate home value helps ensure that you don’t leave money on the table and that your home is priced to sell in the current market.

Plan for Your Next Move: If you’re planning to buy another home, knowing the value of your current property helps you understand how much you can afford for your next purchase. It also gives you clarity on what’s needed for a smooth transition between selling your current home and buying a new one.

Keep in Touch

Hi, Thanks for visit!

Shoot me a text or schedule a quick call, if you have any questions or just to catch up.

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

-

Population

Rent VS Ownership

AVG. selling price (180 days)

Recent Sales (180 days)

Mortgage Calculator

Estimate your monthly payment and see how much house you can afford.